In 2024, Filipinos lost more than P460 billion ($7.8 billion) to scams and fraud with 67% unwilling to report scams to the authorities. It’s clear that the digital age has brought many benefits. It has also brought new risks. One group particularly vulnerable to these risks is the elderly. They are often targeted by online scammers.

Why is this the case? Many seniors are less familiar with digital technology. This makes them an easy target for online fraudsters.

The impact of falling victim to an online scam can be devastating. It can lead to significant financial losses. It can also cause emotional distress.

But there are ways to protect our seniors. This article explores strategies for online fraud prevention. We’ll dive into the importance of cybersecurity for seniors. We will also discuss the role of financial advisors and elder care professionals. They play a crucial part in safeguarding seniors from online scams. Finally, we will look at technology solutions that can help. These tools can provide an additional layer of protection.

Our goal is to enhance the safety of the elderly in the digital age. We aim to empower seniors and their caregivers with the knowledge they need to stay safe online. Be sure to follow us on Facebook and LinkedIn. Now let’s get started

Understanding the Risks: Why the Elderly Are Targeted

The elderly are increasingly targeted by online scams. Scammers perceive them as more trusting and less savvy with technology. This perception, whether true or not, makes them a primary target.

Several factors contribute to this vulnerability among seniors:

- Limited digital literacy and experience

- Higher levels of trust in communication

- Social isolation increases susceptibility

- Access to retirement savings

Many seniors didn’t grow up with technology. They may find it difficult to differentiate between legitimate and scam communications. This lack of familiarity with digital interfaces can lead to costly mistakes.

Social isolation further exacerbates the problem. Seniors who feel lonely might engage more readily with online interactions. This can open the door to scam artists seeking to exploit loneliness for financial gain.

The Philippines ranked #2 globally in terms of self reported lonliness with 57% of the population feeling very or fairly lonely according to a Meta-Gallup global survey

Another reason elderly individuals are targeted is their financial stability. Many have amassed savings intended to last through retirement. This financial security can attract scammers looking for large payouts.

Understanding these vulnerabilities is crucial for developing preventive strategies. Awareness is the first step towards reducing the risk. Seniors, caregivers, and society must recognize why this demographic is at risk.

By acknowledging these factors, we can be proactive in protecting the elderly. Education and support are key components in this ongoing battle. With increased awareness and resources, seniors can better navigate the digital landscape safely.

Common Types of Online Scams Targeting Seniors

Seniors as well as other are susceptible to various online scams, which can cause significant financial losses and emotional distress. Understanding these common scams is essential for prevention.

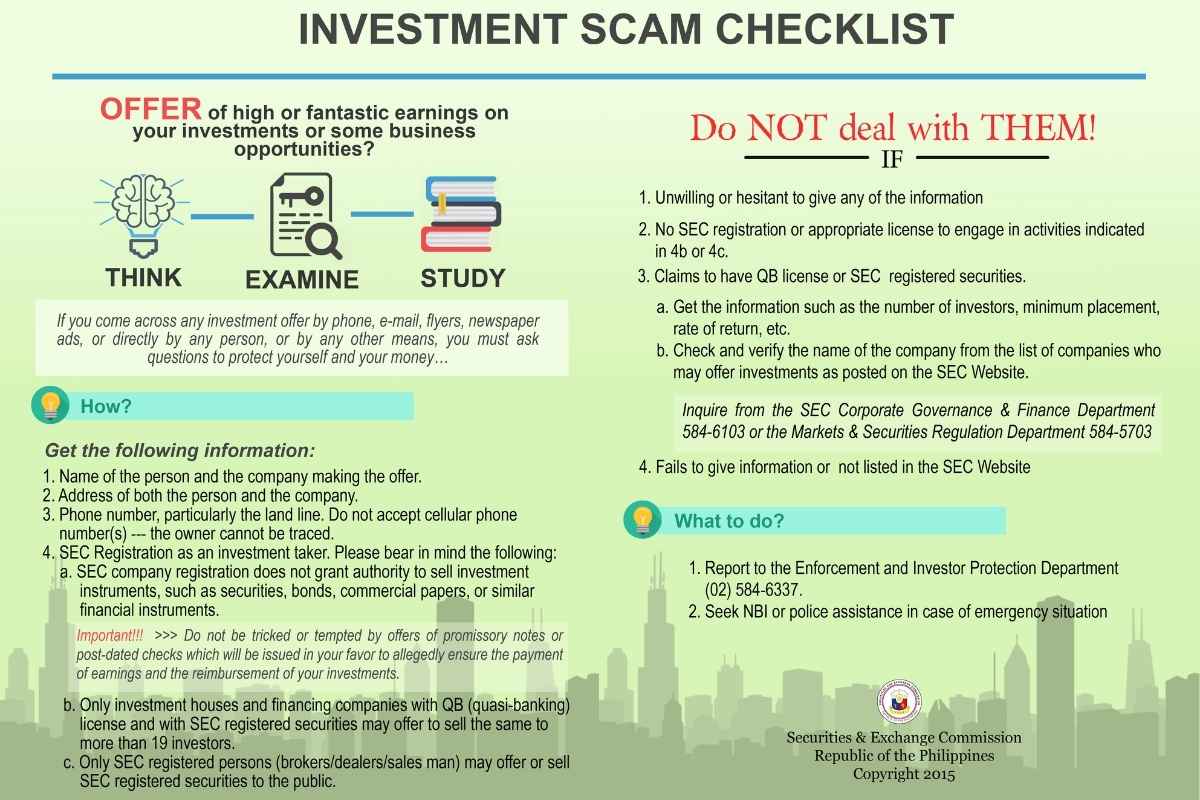

According to the Philippines SEC prevalent scams targeting consumers and seniors include:

- Phishing and identity theft

- Ransomware attacks

- Online shopping scams

- Tech support scams

- Social media scams

- Investment and Crypto scams

- Romance scams

Phishing scams often involve fake emails that appear genuine. These emails trick seniors into providing personal information or clicking malicious links. This leads to identity theft or financial fraud.

Tech support frauds exploit the trust seniors place in computer professionals. Scammers pose as legitimate tech support and charge for unnecessary or nonexistent services.

Romance scams manipulate emotions, targeting lonely seniors. Scammers create fake identities and relationships, ultimately asking for money or gifts.

By recognizing these scams, seniors can take steps to protect themselves. Awareness is key in avoiding falling victim to these deceptive tactics.

Cybersecurity for Seniors: Essential Practices

Cybersecurity is crucial for seniors navigating the digital world. As digital fraud grows, protecting online security becomes essential. Computer and smartphone use remains limited among Filipino seniors. However, they can adopt several practices to safeguard themselves from cyber threats.

- Install and update anti-virus software regularly.

- Use strong, unique passwords for each account.

- Enable two-factor authentication whenever possible.

- Avoid clicking on suspicious links or attachments.

- Regularly back up important data and files.

Keeping software updated is vital for maintaining security. Updates often fix vulnerabilities that scammers exploit. Seniors should enable automatic updates for operating systems and applications.

Cyber awareness is another key factor. Seniors should be educated on common online scams and scam avoidance. Understanding these risks empowers them to stay vigilant and cautious.

Family members and caregivers can support seniors in their cybersecurity efforts. Offering guidance on safe online habits fosters a safer online environment. Regular check-ins can help monitor for any suspicious activity.

By adopting these practices, seniors can enhance their online security. Staying informed and prepared reduces the risk of falling victim to scams.

The Role of Financial Advisors in Elderly Online Safety

Financial advisors play a pivotal role in safeguarding seniors from online scams. They provide crucial guidance on managing finances securely. Their expertise helps seniors identify and avoid fraudulent schemes.

Advisors educate seniors about the telltale signs of financial scams. Knowledge about phishing emails and fake investment opportunities is vital. This knowledge helps seniors make informed decisions and protect their assets.

Moreover, advisors can help monitor financial accounts for suspicious activity. By setting up alerts, they ensure quick detection of unauthorized transactions. This proactive approach is essential in preventing financial losses.

For seniors, building a trusting relationship with their financial advisor is important. It creates a support system that adds another layer of protection. Together, they can develop strategies to maintain financial security and peace of mind.

Elder Care and Online Safety: A Collaborative Approach

Elder care professionals are increasingly involved in protecting seniors online. They should be trained to recognize signs of scam victimization. This awareness helps intervene quickly to prevent further harm.

Families play a vital role in this collaborative approach. Relatives can provide emotional support and guidance on internet use. Regular communication helps seniors feel less isolated and safer online.

Community programs offer additional resources for online safety. They can provide educational workshops and support networks. A collective effort strengthens the safety net for seniors in the digital world. There are several government programs that intersect with these issues.

Technology Solutions for Elderly Safety Online

In the digital age, technology solutions can drastically improve safety for seniors online. These tools offer peace of mind and security. With the right applications, the elderly can explore the internet safely.

Key elements of technological safeguards include secure communication tools and fraud detection. Such solutions are instrumental in reducing scam risks. Seniors can engage with technology confidently, knowing protection is in place.

Here are some key technology solutions:

- Secure messaging apps to protect personal conversations.

- Fraud monitoring services that alert users to suspicious activities.

- Password managers that ensure strong, unique passwords.

By leveraging these tools, seniors can enhance their online experiences. Technology not only protects but also empowers them to remain connected.

Secure Communication Tools and Fraud Monitoring Services

Secure communication tools are essential for privacy in online interactions. These tools encrypt messages, safeguarding personal information. Seniors can communicate without fear of data breaches.

Fraud monitoring services add another layer of security. They detect and report suspicious account activity. Immediate alerts help seniors take action before potential fraud occurs.

Educational Apps and Programs for Digital Literacy

Education plays a significant role in online safety. Digital literacy apps guide seniors through the complexities of the internet. These programs teach essential skills in a user-friendly way.

Educational applications often cover cybersecurity basics. They empower seniors to recognize common scam tactics. By improving digital skills, these apps contribute to a safer online environment for the elderly.

The Impact of Social Isolation on Online Scam Vulnerability

Social isolation can significantly increase the risk of online scams targeting seniors. Loneliness can lead seniors to seek companionship online. This makes them more vulnerable to deceitful individuals.

Scammers exploit this need for connection. They often pose as friends or romantic interests. Such fake relationships can lead to financial exploitation and emotional distress for the elderly.

Being isolated means seniors may lack immediate support from family or caregivers. This absence of guidance can make it harder for them to identify fraudulent activities. Addressing social isolation is thus crucial, not just for emotional well-being, but also for strengthening online defenses against scams.

Legislation to Protect Consumers from Online Scams

Crafting policies to shield seniors from online scams is crucial. Policymakers must take into account the unique vulnerabilities faced by the elderly. Legislation can serve as a powerful tool to deter fraudsters and protect consumers.

In the Philippines, several legislative measures are in place to protect consumers from scams and fraudulent activities. Below is an overview of key laws designed to safeguard consumer interests:

Consumer Act of the Philippines (Republic Act No. 7394)

Enacted to protect consumers from deceptive, unfair, and unconscionable sales practices, this act mandates that businesses provide accurate information regarding the nature, quality, and price of goods and services. It ensures consumers have the right to seek redress and compensation for damages resulting from fraudulent transactions.

Electronic Commerce Act of 2000 (Republic Act No. 8792)

This law addresses issues related to online transactions, recognizing the legality of electronic documents and signatures, thereby facilitating secure online dealings. It penalizes unauthorized access to data and cybercrimes, providing a framework for prosecuting online scammers.

Cybercrime Prevention Act of 2012 (Republic Act No. 10175)

Aimed at combating cyber-related offenses, this act penalizes activities such as identity theft, hacking, and online fraud. It empowers law enforcement agencies to effectively address cybercrime and protect consumers from online scams.

Data Privacy Act of 2012 (Republic Act No. 10173)

This act focuses on protecting personal data and privacy, crucial in preventing identity theft and misuse of personal information—common tactics in online scams. The National Privacy Commission oversees its implementation, ensuring compliance by entities processing personal data.

Securities Regulation Code (Republic Act No. 8799)

This code addresses investment scams, including pyramid schemes and Ponzi schemes, by regulating the sale of securities and imposing penalties on fraudulent investment activities. The Securities and Exchange Commission (SEC) enforces this law to protect investors from deceptive schemes.

Revised Penal Code (Articles 315-318 on Estafa and Other Forms of Swindling)

The Revised Penal Code penalizes acts of fraud, particularly those involving deceit or falsification. Estafa, under Article 315, covers various forms of swindling, including those committed through false pretenses or fraudulent acts, with penalties varying based on the amount defrauded.

Enforcement Agencies

Several agencies are tasked with enforcing these laws and assisting consumers:

- Department of Trade and Industry (DTI): Responsible for enforcing consumer protection laws, particularly the Consumer Act. Victims can file complaints with the DTI’s Consumer Protection and Advocacy Bureau.

- Philippine National Police (PNP) and National Bureau of Investigation (NBI): Both have dedicated units to handle cybercrime and online fraud. Consumers can report incidents to these agencies for investigation.

- Securities and Exchange Commission (SEC): Oversees the implementation of the Securities Regulation Code, investigating and sanctioning individuals and entities involved in fraudulent investment schemes.

Fostering a Safe Digital Environment for Seniors

Finally, creating a safe online space for seniors requires collective effort. Families, caregivers, and professionals must collaborate. With united strategies, seniors can navigate the digital world securely.

Policymakers, financial advisors, and educators should drive comprehensive initiatives. These efforts need to ensure seniors understand online risks and preventive measures. By promoting digital literacy and awareness, we can empower seniors to enjoy the benefits of technology confidently and securely. Such coordinated actions will help protect the vulnerable and cultivate a safer digital environment for everyone.